Opinion: A bad idea for New Hampshire

New Hampshire Flag marcusamelia

| Published: 04-25-2024 3:52 PM |

Adam Czarkowski works in the technology sector and lives in Penacook.

Susan McKevitt’s recent opinion column “It’s time to properly fund education” in the Concord Monitor reads like a case for a state income tax without saying the words “income tax.” It advocates for more state funding for education but then rules out increased property taxes and a sales tax. That leaves only one tool left in the tax shed, which is an income tax.

In 1990 Saturday Night Live did a skit called “Bad Idea Jeans.” In the skit, the actors made statements that were obviously a bad idea to any rational person. When I hear anyone advocate for a state income tax, I picture them wearing a pair of those jeans. A state income tax is the worst idea in New Hampshire politics.

According to WalletHub, a personal finance website, New Hampshire had the second lowest individual tax burden in the country in 2023. The only state that beat us was Alaska with its oil wealth. By comparison, our neighboring state Maine had the fourth highest individual tax burden. For those that claim an income tax would reduce our property taxes we only need to look at Maine. Maine has an income tax and yet they have the highest property tax as percentage of personal income in the country! Wow, even higher than New Hampshire.

Some claim an income tax would make the mythically rich people pay their “fair share” but we know that isn’t true. The wealthy can afford tax attorneys who can minimize tax liability or at least delay it. The truth is, an income tax hurts regular folks who count on a paycheck every two weeks. You cannot hide that from the government. With the Biden administration’s inflation, the last thing New Hampshire workers need is the state stealing money from their paychecks.

When funding for education is discussed the one topic that is taboo is what about the costs? According to the NH Department of Education student enrollment in public schools has declined over 20% in the past 21 years. During that same period, the cost to educate a student has increased over 87%. Why? Why do we accept annual school budget increases without blinking an eye? Why does a certain school board feel comfortable building a $175 million middle school in the woods when enrollment is down 13% in that district over the past decade? Why does it cost $20,000 a year to educate one student? If the goal is to alleviate taxpayer pain, spending less is always part of the discussion.

As the state elections gear up this year I too will be carefully vetting the candidates. The only candidates that will get my vote are ones that take the pledge against an income or sales tax. The idea of a state income tax, just like a pair of bad idea jeans, needs to go in a trash bag and be driven to a Goodwill out of state.

Article continues after...

Yesterday's Most Read Articles

A turbulent 50-year history: Inside the rise and fall of a tiny Catholic college in Warner

A turbulent 50-year history: Inside the rise and fall of a tiny Catholic college in Warner

Update: Reactions for, against the more than 100 arrested at Dartmouth, UNH

Update: Reactions for, against the more than 100 arrested at Dartmouth, UNH

Softball: Cassidy Emerson may have eight freshmen on her team, but the Falcons have glided to an 8-1 start

Softball: Cassidy Emerson may have eight freshmen on her team, but the Falcons have glided to an 8-1 start

Franklin police arrest man after accidental shooting Wednesday

Franklin police arrest man after accidental shooting Wednesday

Opinion: Sports have never been fair

Opinion: Sports have never been fair

Hopkinton chocolatier transforms chocolates into works of art

Hopkinton chocolatier transforms chocolates into works of art

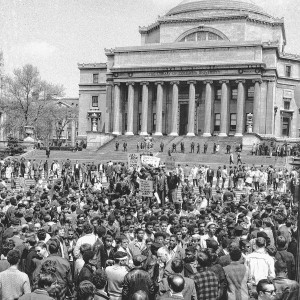

Opinion: It all started at Columbia

Opinion: It all started at Columbia Opinion: Students resist: Berkeley to Gaza, Columbia to Jenin, UNH to Rafah

Opinion: Students resist: Berkeley to Gaza, Columbia to Jenin, UNH to Rafah Opinion: New Hampshire, it’s time to acknowledge the stories of suffering

Opinion: New Hampshire, it’s time to acknowledge the stories of suffering Opinion: A digital equity plan for Granite Staters

Opinion: A digital equity plan for Granite Staters